Everybody Has a Plan Until They Get Punched in the Face. When the Facts Change so Should Your Investment Plans.

[This piece originally appeared on p. 50 in the Q3 2022 issue of MD Next. Check it out to see more details.]

~By Michael Schmanske

It’s official folks, the dance is over. Turn off the music and the last one out gets the lights. You don’t have to go home but you can’t stay here. The Fed (the Federal Open Market Committee) busted into the school gymnasium and stole the punchbowl by raising rates and ending Quantitative Easing. The impact started in May and the equity markets as a rule get ahead of the action, but be clear. This bear market will not be complete until we know that the Fed will be done tightening soon. In the meantime, the central bank is attempting to unwind the longest and largest monetary policy experiment in history.

If you read my blog, “Life, Liquidity and the Pursuit of Alpha” from early 2021, you’ll know I was highly suspicious of both the Fed’s monetary policy and the crazy valuation it was driving in the public markets. Especially for those companies targeted as “growth at any price.” Unfortunately the same monetary bubble pandemic that infected retail investing during the rally from March 2020 through the end of last year also spread to many areas in Venture Capital (VC) and the Private Equity (PE) markets. Later pre-IPO rounds in particular became inflated, and many investors new to private markets jumped in heavily.

He who rides a tiger is afraid to dismount.

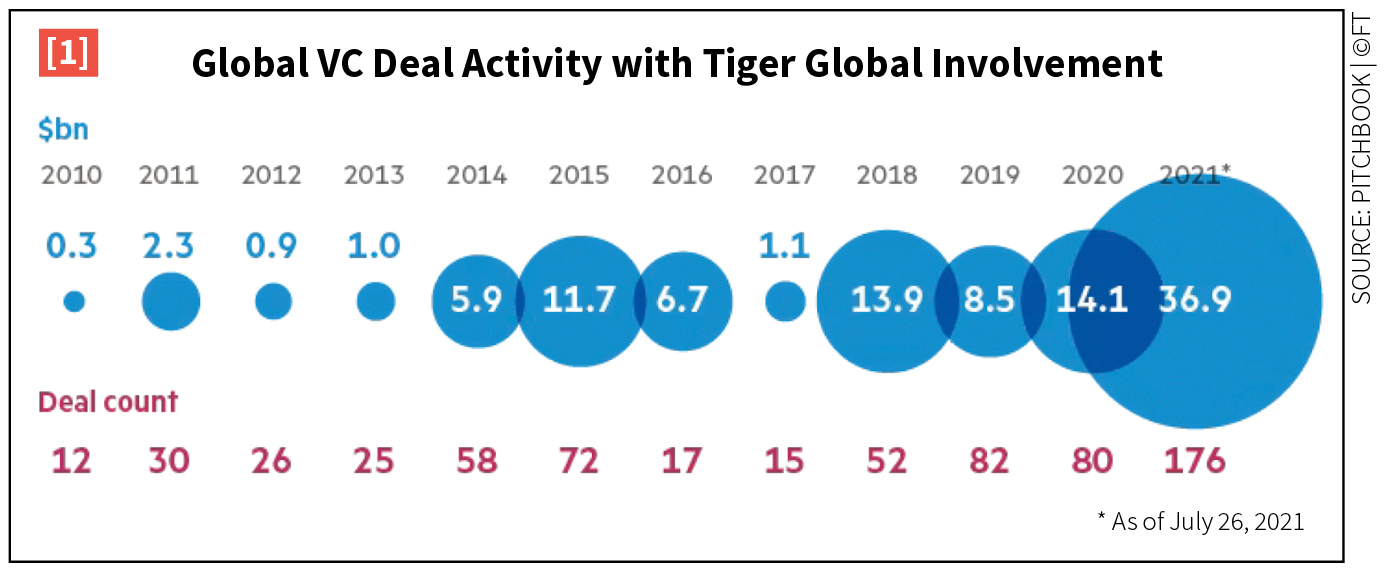

Let’s use an example. Tiger Global is a hedge fund group that was widely recognized as a leader in the new race for expanding the investment landscape into private companies. They had $95 Billion assets under management as of October, ‘21. By the end of that year between fundraising and portfolio appreciation that had grown to more than $150B. Now? $75 Billion in AUM. Ouch! What happened? (hint, not withdrawals).

Short answer—they jumped into a very frothy market with both feet. At the wrong time. Like a madman barista they were responsible for creating that very “froth”. (I wonder if they know how to make those cool shapes in the foam?).

Let’s look at when their strategy changed. Initially, things were going swimmingly as they tore through the Venture Capital marketplace. Look at their growth [1].

As of June 2nd the flagship fund had dropped 52% this year alone. Management is cutting fees and attempting to placate investors. It hasn’t stopped the bleeding. They recently created liquidation sidecar funds for investors to process redemptions in illiquid assets.

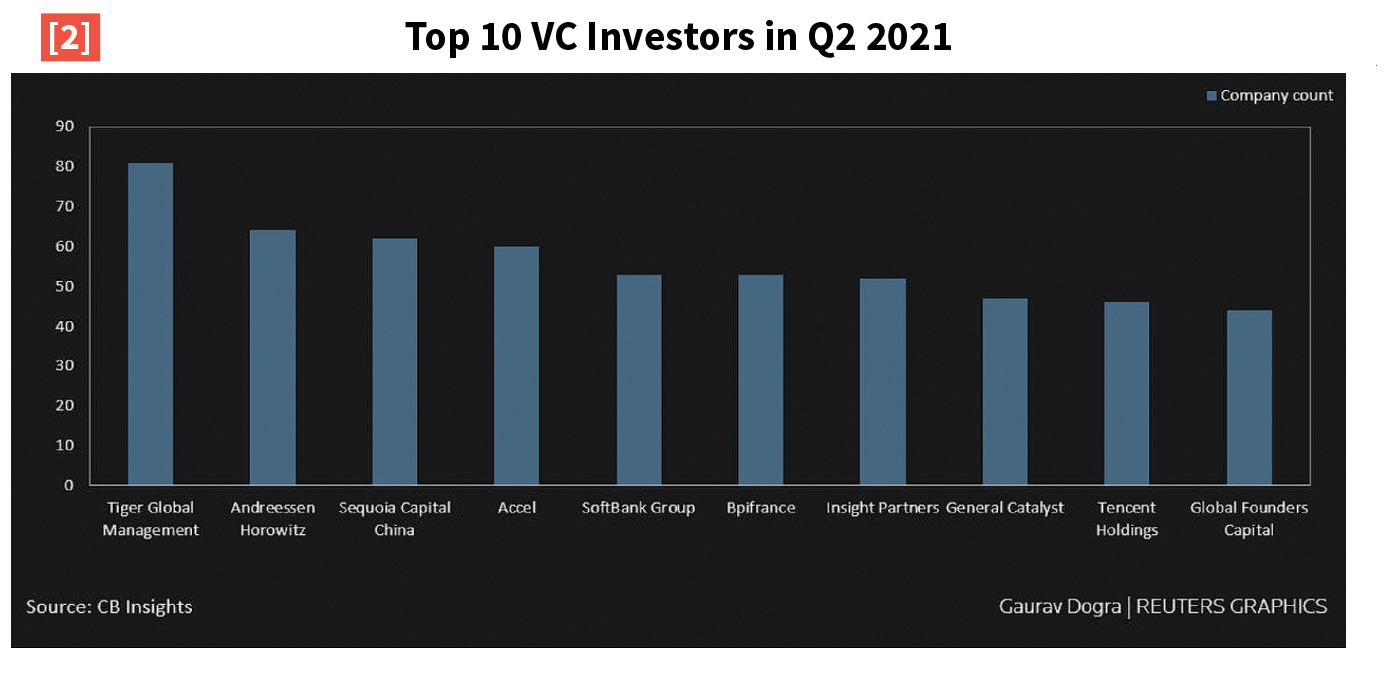

Don’t blame Tiger or Private Equity alone. The bloodbath happened because of the growth obsessed activity in the public markets. Cathy Woods was a hero for years for the performance of her ARK fund. Followers of the market know what has happened there…. [3]

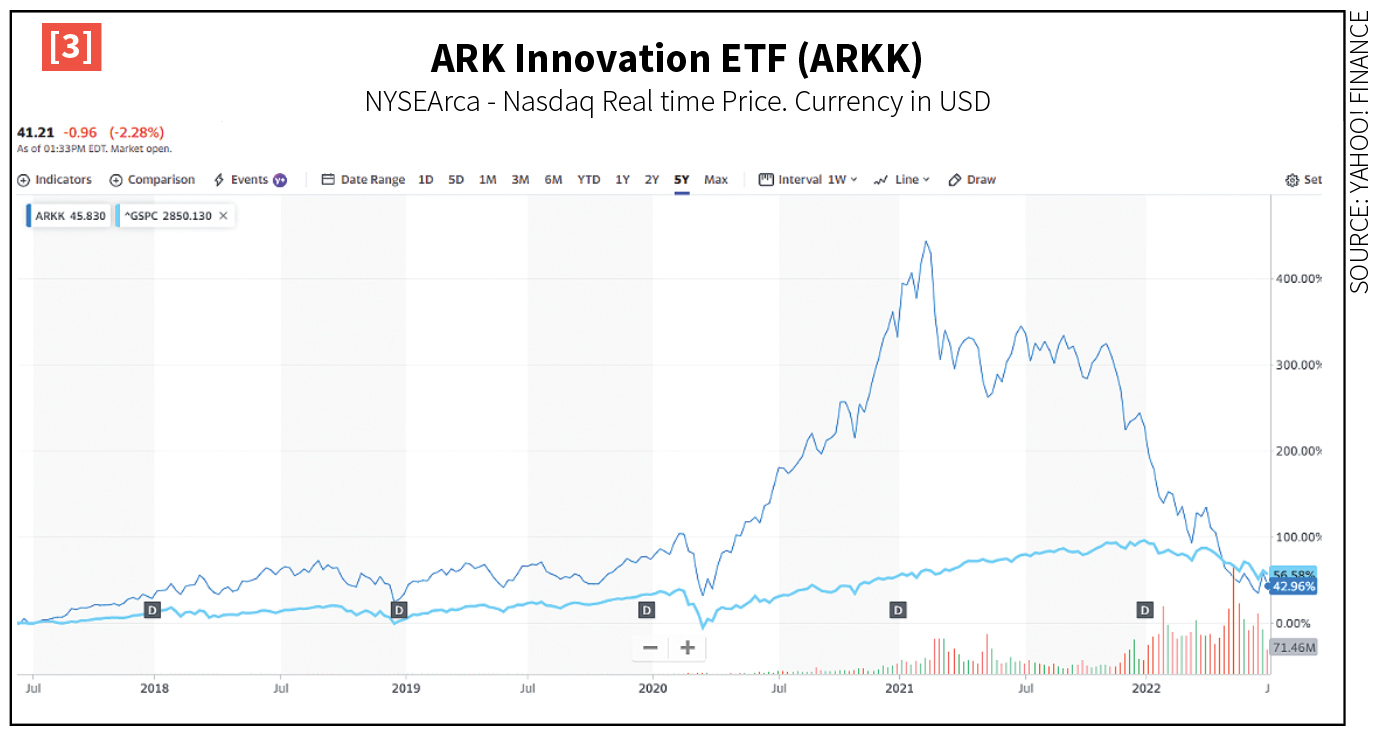

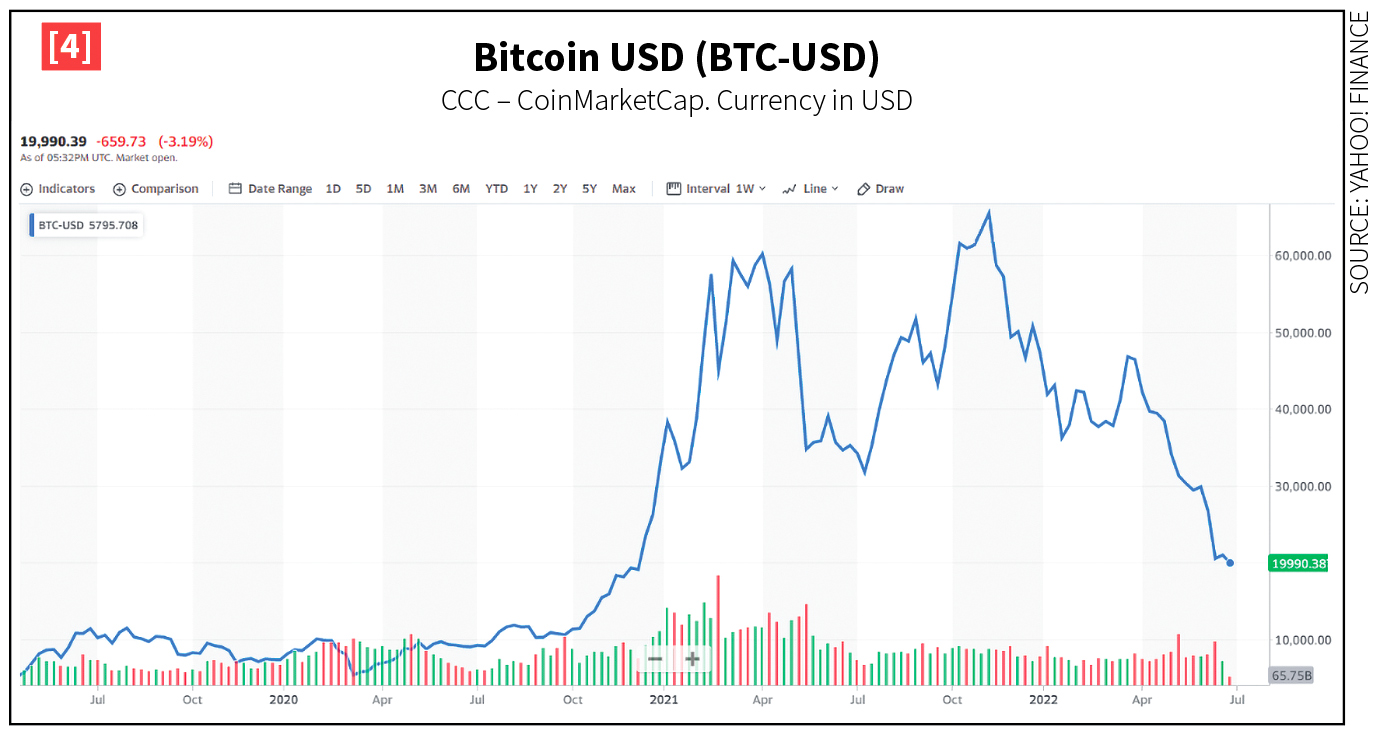

Let’s look at the ultimate benchmark for speculative activity. Bitcoin vs. the USD. [4]

That’s one heck of a round trip!

The times they are a changin’.

The fact is money wants to go where it will be rewarded. In speculative markets one is not rewarded by being right about a company, rather you are rewarded for being right about where everyone else is going next. Economists call it the “Keynesian Beauty Contest”; judges “win” by selecting the faces they believe the rest of the voters will find most attractive, rather than those they may personally find the most attractive. Think of it as gambling on who the audience will pick for America’s Got Talent. It is a valuable model to keep in mind to help view the financial markets with healthy skepticism, but not particularly informative for good investing.

More importantly: What does this mean from here? Are you looking to manage a fully invested portfolio or do you have money to allocate—“Dry Powder?” Let’s focus on investing your dry powder, because discussing what to do if you are completely all-in already will likely require some therapy first. Or at least a double of good bourbon.

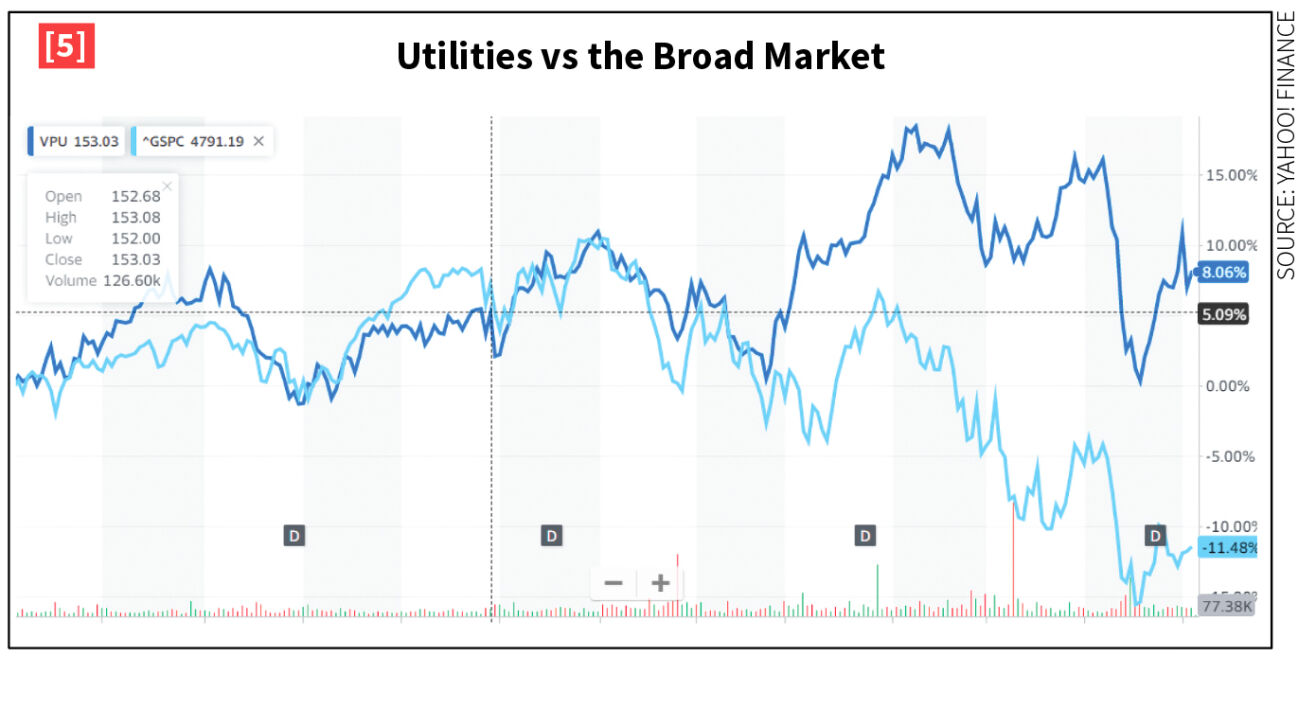

Classically, in this phase of the market we are meant to look for defensive stocks: Utilities, Consumer staples, etc. [5]

To be fair, I am at heart a value investor, so at the time of publication I actually like those cyclical and value sectors along with financials, home-builders and many of the other hated sectors from the last decade. Value investors like to invest where no one else is looking because they believe “the truth will win out.” Growth investors like to buy ahead of other investors and sell to them as the asset appreciates.

But I’ll like those sectors a lot better when I know the recession and fed rate hikes are past us. In the meantime, cheap stocks can get cheaper. Your broker will likely advise you to hide in MSFT, AAPL and other high power, cashflow-strong tech names. This is not a bad idea but they also won’t outperform the market greatly over the next five years because that’s where everyone is already hiding.

Where do we go now?

I’ve said it before, I’ll say it again: I’m working in this field because I believe early-stage healthcare represents the single greatest secular investment opportunity in any field, sector or asset class.

Repeat after me: “You can find growth and good value in an inflation-protected, uncorrelated investment with strong long-term trends.”

(Hmmmm, I might use that as a meditation mantra. It just makes me feel all warm inside.)

Why is that early stage healthcare?

- Valuations: These companies need money, so your entry point is cheap.

- Growth: If successful they grow like crazy but that’s on a case by case basis so you need to travel with educated companions.

- Healthcare is inflation protected: In fact most innovation is helped by inflation as providers seek to improve productivity to offset increased costs.

- Demographics: The need for and money spent on healthcare will only increase over time both due to aging and global economic integration. (To manage this see productivity concerns above as an example).

- Isolated from the investment cycle: The nature of early stage healthcare means you do not blow in the wind of the broader markets. Don’t invest like a Tiger, invest like a Builder.

How are they different from the aforementioned Tiger global strategy? Their philosophy of “move fast and move on to the next deal” led them to invest primarily in companies that were hot or sexy. They based their investments on the Keynesian Beauty Contest model I mentioned earlier. Specifically whether the market will continue to finance the company at higher valuations during follow-on funding rounds by feeding off of later investors. This is a great strategy so long as the music keeps playing, but now it’s time to find a chair. Flying taxis, multiple Electric Vehicle companies, asteroid mining SPACs and Web 3.0 might play out very well eventually, but I’ll invest in the steak not the sizzle thank you.

Here is the thing: you can participate in market timing if you like. I prefer to believe long term returns are generated by choosing great companies, investing at the right price and working with the company to create value. If you agree with this philosophy, I highly recommend checking out the startups in the AngelMD community.

Do the work, the most valuable investment is your time.

Stay tuned for future finance content and AngelMD Academy classes on these topics and many others. If you’d like to know more please reach out at MDNext@AngelMD.com.

…

Michael Schmanske is a 24-year Wall Street veteran with experience on trading desks and asset managers. He graduated with degrees in Aerospace Engineering from MIT and a Masters from Princeton University. Mike is the Managing Director for AngelMD Capital and runs research and Analytics at AngelMD where he is happy to exercise his inner nerd on a regular basis by supporting the most innovative entrepreneurs and cutting-edge medical startups.